Loan Limits Are Higher For 2020

August 26, 2020

With the calendar now officially flipped to 2020, Fannie Mae, Freddie Mac, and the Federal Housing Administration are now backing larger mortgages than they were just a few days ago.

That’s because the 2020 loan limits for each of those agencies are now in effect. And each of the agencies’ loan limits are higher for 2020 than they were in 2019.

The agencies’ loan limits (the highest dollar amount they will back on a mortgage) are dictated by the Federal Housing Finance Agency’s home price index.

And that index rose in 2019, with home prices up nearly 5% over last year’s totals.

With higher home prices come higher loan amounts, and the FHA, Fannie Mae, and Freddie Mac all recently adjusted their loan limit amounts to account for higher home prices.

Those higher loan limits took effect on Jan. 1, 2020, meaning the FHA, Fannie Mae, and Freddie Mac are all now backing larger loans.

Fannie, Freddie 2020 loan limits

At the end of November, the government-sponsored enterprises announced that the 2020 maximum conforming loan limit was increasing from 2019’s level ($484,350) to $510,400 for 2020.

This increase marks the fourth straight year that the FHFA has increased the conforming loan limits after not increasing them for an entire decade from 2006 to 2016.

FHA 2020 loan limits

Meanwhile, the FHA loan limit also increased as of this week.

The 2020 FHA loan limit for most of the country is now $331,760, however Miami-Dade County is at $373,750.

FHA is required by the National Housing Act, as amended by the Housing and Economic Recovery Act of 2008, to set single-family forward loan limits at 115% of median house prices, subject to a floor and a ceiling on the limits. FHA calculates forward mortgage limits by Metropolitan Statistical Area and county.

There are a number of counties (approximately 70) where the median home price far exceeds the FHA loan limit floor. Those areas where the loan limit exceeds this floor are considered “high-cost areas”, and HERA requires the FHA to set its maximum loan limit “ceiling” for those high-cost areas at 150% of the national conforming limit.

Therefore, for those approximately 70 “high-cost” counties, the FHA’s 2020 loan limit is $765,600, an increase of nearly $40,000 over 2019’s total of $726,525.

According to the FHA, the loan limit increased in almost all of the 3,233 counties where it backs loans, but there are a handful of counties where the loan limit actually decreased.

FHA’s 2020 minimum national loan limit, or “floor,” of $331,760 is 65% of the Fannie, Freddie loan limit of $510,400. This floor applies to “low-cost areas,” which are counties where 115% of the median home price is less than the floor limit.

Starter Homes

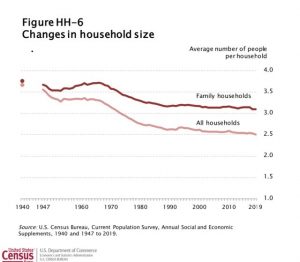

The so-called “starter home” these days may be big enough until the kids leave for college. The growth in multi-generational housing plays into this as well.

Unless the homeowner was living in a small single-family resident or condo, the four-decade push of bigger homes fit their needs.

As you can see below, we got as high as 2,698 for the average square feet floor area for single-family units in Q2 2015:

Married with Children!

It is true that after the housing bubble and crash, the lack of equity prevented some people from moving and led to an uptick in housing tenure.

But that is an old story.

Today, people move because of kids, school, jobs or divorce. Aside from periods of a job loss recession, inventory for both new and existing homes has been steady since 1996.

Moving forward in this decade, we do have one possible positive trend that could facilitate more move-up buyers and an increase in inventory in the starter home market… Kids!

The U.S. is entering into a big demographic patch of people ages 30-39 — and with this age group comes marriage and kids.

An increase in children means more first-time homeowners should be move-up buyers if their current home is too small. Birth rates, while currently low, have the potential to grow in the next 10 years.

Housing marketers love “if-only” excuses for why the housing market is not at record-breaking highs. “If only the inventory were better, we would have more sales. If only interest rates weren’t so gosh-darn high, we would have more sales.”

Beware of the “if-only” excuses and stick to the data if you are interested in understanding the U.S. housing market.